Zakat

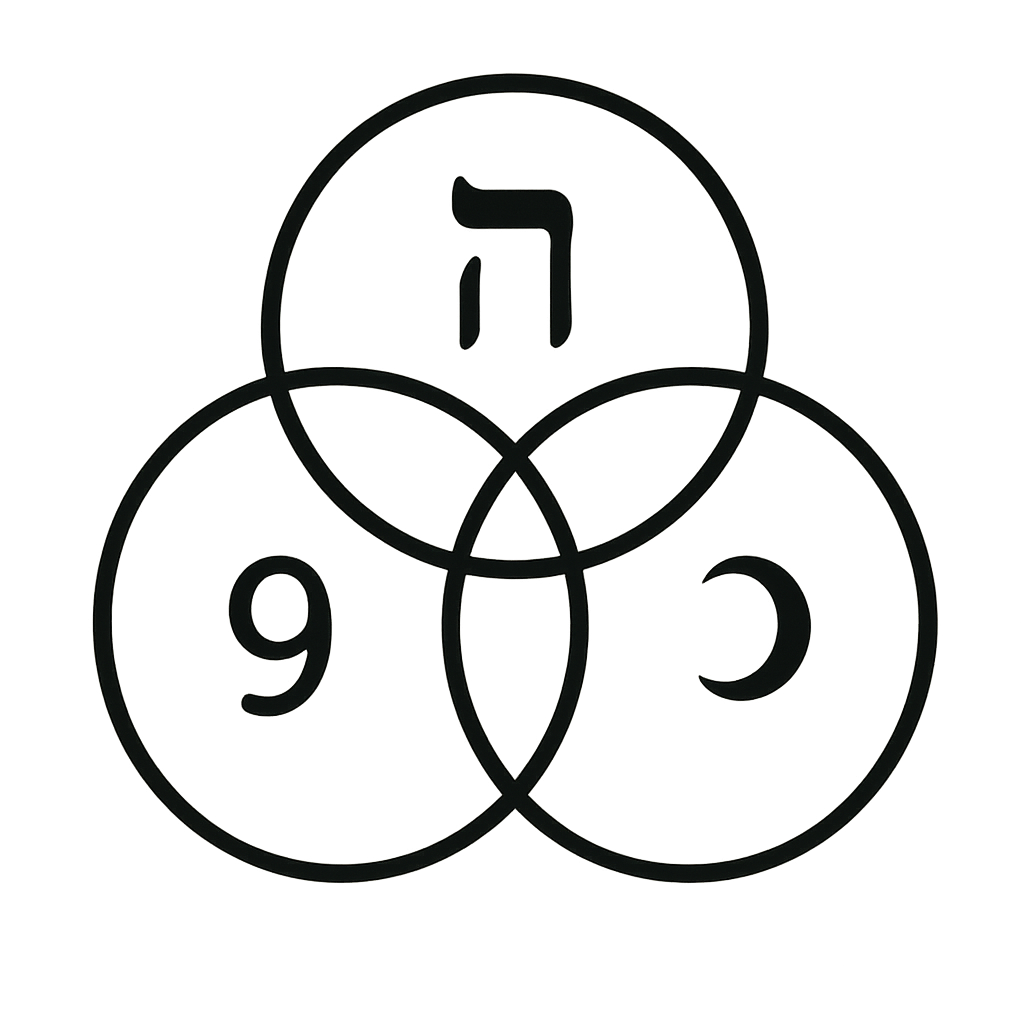

Gematria Values

Zakat (Arabic: زكاة, romanized: 'Zakāh', lit. 'that which purifies') is a form of alms-giving treated in Islam as a religious obligation or tax, which, by Quranic ranking, is next to the salary of prayer (salah) in importance. Zakat is based on stored wealth, and is typically 2.5% of a Muslim's total savings and wealth above a minimum amount known as nisab. It is paid to the poor, needy, slaves, debtors, in the cause of Allah, and to travelers. The term zakat can be translated as "that which purifies", it refers to the purification of a believer's wealth and assets. In Hebrew, the term can be translated as צדקה (Tzedakah), which refers to the religious obligation to do what is right and just, including giving charity. In Turkish, it is known as "Zekât", and in Persian, it is called "Zekat" (زکات). Zakat is one of the Five Pillars of Islam, along with Shahada (faith), Salat (prayer), Sawm (fasting), and Hajj (pilgrimage). The practice is considered a means of purifying one's wealth and gaining spiritual growth, as well as supporting the poor and needy in the community.

Wikipedia Information